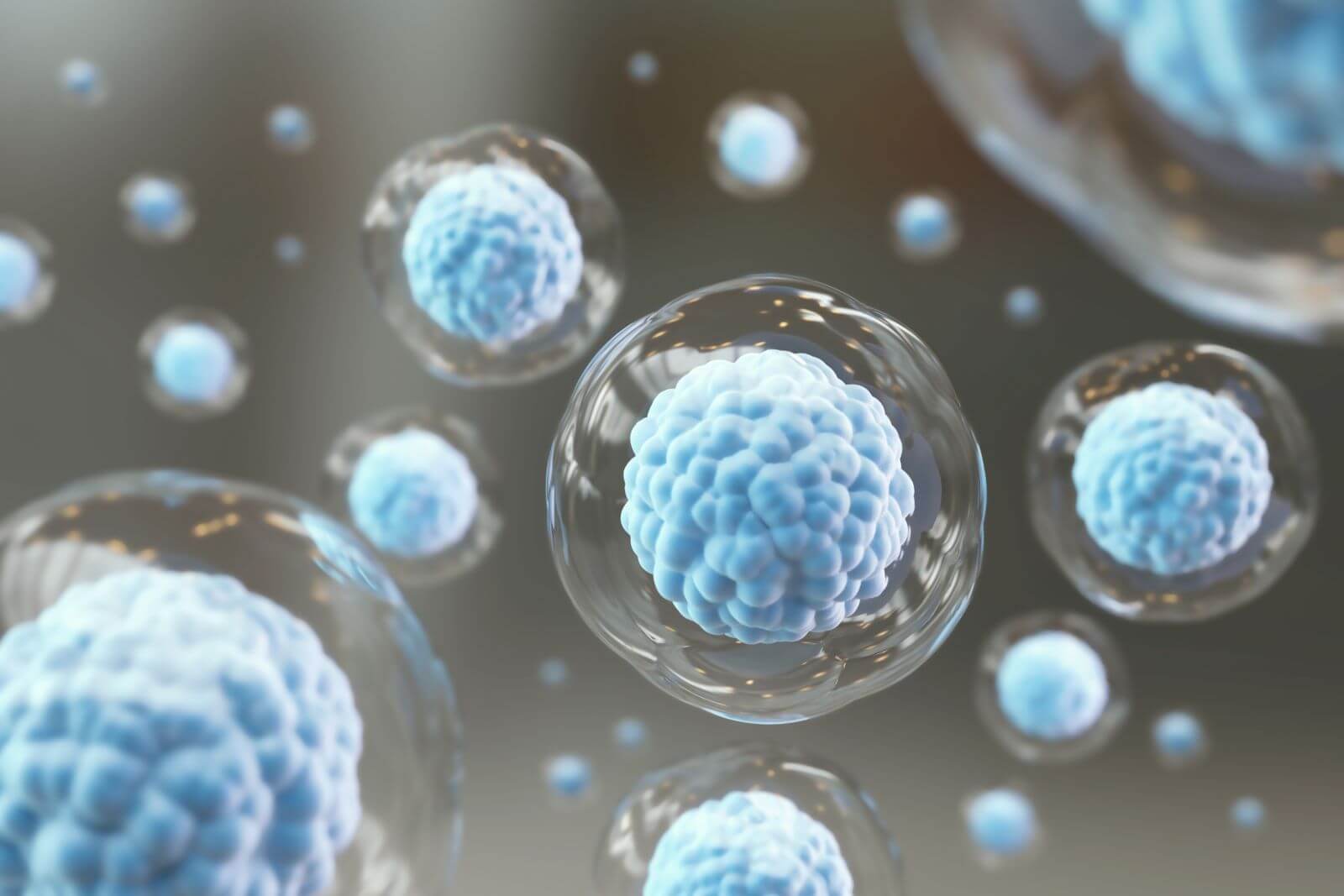

Today, only 18 cell and gene therapies have made it to the FDA approved therapies list. Only 14 have been approved for the European market. This means that very few therapies have made it to the market. In the US, the average market entry price of a therapy (excluding the tissue engineering field) is 541k USD. So they are not only rarer, but also much more expensive than traditional medicines.

The sales price is influenced by multiple factors like Cost of Goods (COG), regulatory requirements, target market (or commercial aspect), and the development just to name a few. In this blog post one will be highlighted. You will learn more about the GOC aspect: what is this cost comprised of and how can you reduce it?

For other factors stay tuned by subscribing to new articles.

Broadening the field

‘From needle to needle’ is the routine flow of a production cycle: from the patient sample collection until the injection of the final cell therapy product. In case of allogenic cell therapies the route can start with the collection from multiple different patients and finishing with the injection of the final product in a broad cohort of receiver.

Typically, a routine manufacturing process can be divided into four subcategories, each with corresponding costs: the sample collection cost, the processing cost, the capital cost, and the delivery cost.

Sample collection

The processing cost

The processing cost consists of the operational cost, the yield and the QC cost. The operational cost is largely consumed by labor, process aids and consumables costs that are required to run through the entire process (this section ranges from growth media to T-flasks, tubing and single use items, e.g. single use bioreactors).

The yield depends on the type of therapy. For autologous therapies, a minimum quantity is required, whereas for allogenic therapies there is value to be gained in producing in multiples of the minimum quantity, as this can be used for other patients as well.

Quality control cost encompasses every action to verify that production is running on target. Typically, this consists of sample analysis of intermediary process stages and the end product. The overhead cost of skilled operators, the lab equipment and keeping it calibrated and validated is also a significant chunk. QC is a key step to releasing the final product to the patient. It is however a verification, and does not alter the product created.

Capital cost

The capital cost consists of process equipment and facility investment costs. This ranges from the clean room, the non-disposable equipment used to process the cell therapy and the development of the cell therapy that needs to be recovered. This cost is highly dependent on the specifics of the cell therapy. In general, the following adagio applies: the higher the automation and closedness of a system, the more robust the process result will be, but also the more expensive (from an initial investment perspective).

Delivery cost

Conclusion

When evaluating and allocating costs of cell therapies to these subdivisions, a few things come to mind. the ways to immediately optimize the sample collection and the delivery are limited.

Two large cost areas that can be studied and designed are the processing and the capital cost. They act as a balancing force. The more development time is spent on optimizing and automating, the more robust the cell therapy will become and the less manual labor and consumables or process aids will be required. This can also impact the level of assuredness or QC that is required.

The key point is to find the balance between capital expenditures and operational costs. There is only one way to achieve this: you should systematically assess the risks and the benefits involved, by offsetting it to scientifically sound data, and make investment calls based on that data.

And that is precisely what QbD can do for you. Our company is your perfect development partner for ATMP companies out there. If you want to learn more, please check out our electronic solution branded “Cell by Design”.

Putting theory to practice

For a recent project, the COG approach was intertwined with the assessment of the development strategy of a cell therapy. For multiple potential process improvement options (intended to close and automate to a certain or full extent) a calculation was made for three scenarios: targeted demand (1x), low demand (0,5 x) and high demand (5x). For each of those multiple process improvement options the costs (taking into account all factors listed above) were calculated and plotted in a graph. This way, it becomes very clear how cost of goods behaves depending on the different growth scenarios and the potential technology to use.

Taking this one step further: using the same approach, a calculation can be made by plotting the cost per batch vs the number of batches. In this graph you can see all of the options in scope within the graph and clearly see the pay-off at the intersections.

.jpg)

.jpg)

.jpg)

.png)

.jpg)